People who own property in the Austin area recently received new valuations from the local appraisal district. This number, known as your appraised value, estimates what your property would currently sell for in Austin’s record-breaking housing market.

The appraisals are a lot higher than they were last year. According to the Travis Central Appraisal District, on average, appraised values rose 56% over the past year.

But if you live in the house you own, and have filed what is called a homestead exemption, the amount you have to pay taxes on is entirely different. This is called your “taxable value,” and it is probably much lower than the estimate of what your home would sell for — unless you bought your house in the past year. Then those numbers are likely the same.

Still confused and in shock? We got you.

The appraised value of my home went up more than 50% in the last year. Does that mean my taxes will go up that amount?

Almost certainly no.

If your property tax bill does go up — and we don’t know that it will — it’s almost certain it won’t increase by anywhere close to that amount. That’s because while the amount your home would sell for can go up any amount year over year, the state limits how much of that value you can be taxed on.

Consider the example of Matt Largey, projects editor at KUT. He bought his home in Southwest Austin in 2013 for around $155,000. Since then, its market value has more than tripled. The Travis Central Appraisal District now estimates that his three-bedroom home would sell for nearly $461,000 on today’s market.

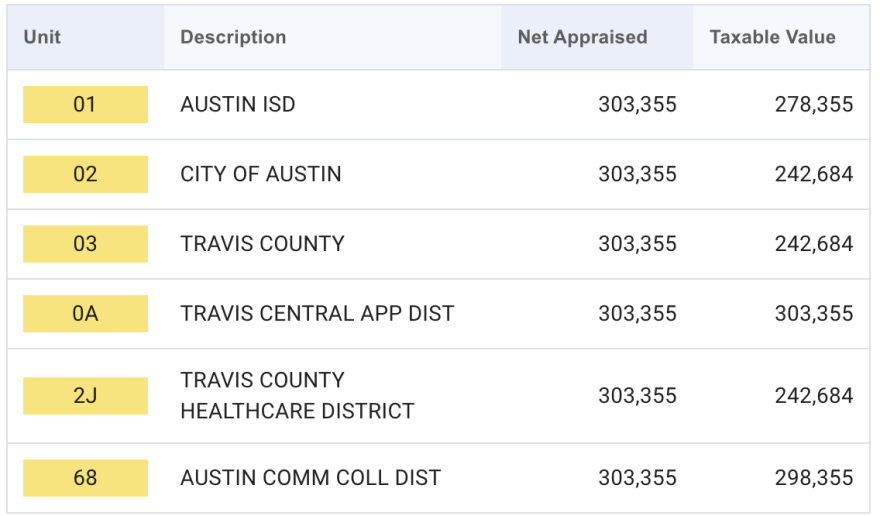

But he won’t be taxed on that amount. The "Net Appraised" column shows Largey's taxable value. (Sort of. It depends on the taxing entity. We'll get to that later.)

When he bought his house, his appraised and net appraised values would have been the same number. His appraised value is subject to the market; the past few years, market values have been increasing rapidly. The same is not true for the net appraised, which is subject to a state cap. This number begins increasing 10% annually starting the year after you bought your home.

You are taxed on either the appraised or net appraised value, whichever is lower in a given year. For Largey, and probably many people in Austin, that lower number is going to be the net appraised.

Once you've determined that taxable amount, each taxing entity applies various exemptions, or "discounts," if you qualify. The City of Austin, for example, allows owners who live in their homes to exempt one-fifth of their taxable amount from taxes. As a result, Largey will only pay property taxes to the city based on $242,684 of taxable value.

So, I’ll ask again: Will my taxes go up?

We don’t know yet.

Later this summer, all the entities that collect taxes will set their tax rates. This includes school districts, cities, counties and other entities. Then, they will apply these rates to the amount they’re permitted to tax you on.

Say the City of Austin sets its tax rate this coming fiscal year to $0.541 per $100. (That’s what the tax rate is this current year.) Largey would owe nearly $1,313 in property taxes to the city. He will also pay taxes to five other entities, and the amounts will depend on their respective tax rates and exemptions.

According to TCAD, you can expect to begin seeing changes in your property tax bill starting in October.

Is there a chance my property tax bill will actually go down?

Sure. Maybe.

The City of Austin says it expects to lower its tax rate this year because values have gone up so significantly. The city also has to be careful not to exceed a state cap on how much new property tax revenue it can collect. State lawmakers in 2019 passed a bill lowering that cap from 8% to 3.5%. If the city wants to exceed this number, it has to hold an election.

But a lower tax rate doesn’t always mean lower taxes. For example, the city could lower the tax rate to an amount that's not enough to offset the rise in taxable values. This happened in 2018 when the Austin City Council voted to lower the tax rate from $0.4448 to $0.4403. Even though the tax rate was (slightly) lower, the city estimated the owner of a home worth $400,000 would pay about $42 more in city property taxes than the year before.

What does it mean to protest my property appraisal?

You can contest your appraised value, or the market value. But you cannot contest your net appraised value, which is what you're likely being taxed on.

Over time, protesting your property appraisal may mean you can get it closer to your net appraised value. This could be helpful in an alternate universe in which Austin’s housing market crashes and values tank, and suddenly your appraised value is less than your taxable value. Then you’d be taxed on the smaller number.

Why should renters care about this?

Renters may be more adversely affected by property appraisals than homeowners who live in their homes (i.e., not landlords).

Landlords don’t get that 10% cap on net appraised amount increases each year. They also don’t get to hide a fifth of their taxable amount from taxes, as the city allows owners who live in their homes to do. So, while market values go up wildly, so do landlords’ taxable amounts, which, in turn, could get passed on to renters, who are already feeling strained by rising prices.