Want a surefire way to bond with someone waiting in line at the grocery store or standing next to you in the dog park? In Austin, try griping about property taxes.

The state has no income tax, so property taxes tend to be higher than in other parts of the country. And as the values of homes go up, property taxes tend to follow suit (although, not nearly as quickly).

But while we love to complain about them, property taxes are also incredibly misunderstood. (Kind of like teenagers.) Let’s try to demystify them.

How are property taxes calculated?

Hold up. Let’s take it little by little.

Fine. What’s the first step in calculating someone’s property tax bill?

That would be the appraisal. Each April, the Travis Central Appraisal District (TCAD) sends property owners an appraisal, or an estimate of what their home or business would likely have sold for at the start of the year.

Because appraisal numbers are based on the market, they fluctuate. When the sales price of homes in Austin skyrocketed during the pandemic, so did appraisals. Now that housing costs are dropping, appraisals have followed.

OK, so I got my appraisal. Now what?

Let’s consider the plight of one anonymous homeowner in Central Austin.

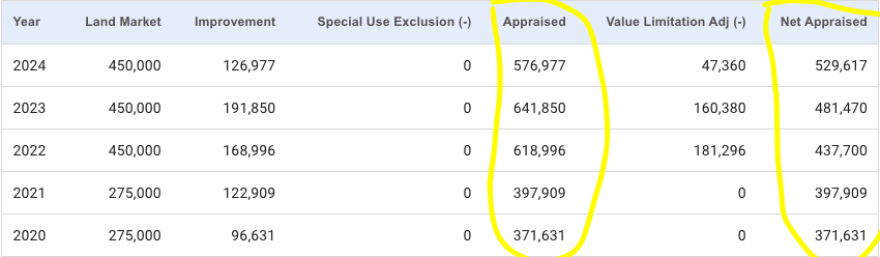

When figuring out how someone’s property tax bill is calculated, you should start with the “Appraised” and “Net Appraised” data on TCAD’s website. The “Appraised” column shows a property’s appraisal each year.

This year, the appraisal district estimated this house would have sold for nearly $577,000, down 10% from last year.

So, this is the amount the person is taxed on, yes?

Not so fast. Typically, no.

Look now at the “Net Appraised” column. That number goes up 10% year over year, a limitation approved by voters in 1997. The taxable value, or the amount a property owner is taxed on, is either the “Appraised” or “Net Appraised” number, whichever is lower.

Because home values tend to go up so quickly in Austin, many homeowners’ property tax bills are based on the “Net Appraised” number instead of the “Appraised” number. That is the case for this homeowner, whose “Net Appraised” amount is about $50,000 less than their “Appraised.”

So, this is the amount the person is taxed on, yes?

Not quite.

The state also allows homeowners to claim various exemptions, or discounts, on the taxable value of their property. If you live in the home you own, you get a discount — what’s known as a homestead exemption — on your taxable value. Veterans, people over 65 and people who are disabled can get additional exemptions.

Let’s take a look at the taxable value for our anonymous homeowner. This person lives in their home and is over 65, so they’ve filed a homestead and senior exemption. While their “Net Appraised” was $529,617, they’ll actually pay taxes on a much smaller amount. That’s because each taxing entity — the city, county and local school districts — applies its own exemptions. Discounts on top of discounts on top of discounts.

In the case of city taxes, the City of Austin will tax this homeowner on roughly $299,000, rather than that much larger “Net Appraised” number.

I’m exhausted. Can we just skip ahead to the tax bill?

We’re almost there. We now know what number property owners are taxed on. So, how do we get to the tax bill?

By October, most taxing jurisdictions will have set what’s called a tax rate. This is the portion of your taxable value they will take to pay for things like police, teachers and roads. The City of Austin’s tax rate last year was 0.4458, meaning the city takes about 45 cents of every $100 of your taxable value. Phew. Math.

Here’s our anonymous homeowner’s property tax bill for the past year:

This homeowner owed about $3,000 in property taxes last year, which will be distributed to all the taxing entities. This person’s tax bill went down over the past several years, a trend that’s become more common as state lawmakers have passed various tax-trimming measures.

What do property taxes pay for?

Tons of things. Property taxes are collected by cities, counties, community college districts, public schools, appraisal districts and health care districts. Walk outside your house and you’ll quickly encounter something property taxes have paid for: a sidewalk, a road, a street sign.

Wherever you are, property taxes will be.