Unbeknownst to some, the City of Austin has licensed five ride-hailing companies for operation. In case you haven’t opened your mailbox or clicked on your TV recently, two of those companies, Uber and Lyft, are currently embroiled in a public vote over what regulations the companies should be subject to.

“We can all agree,” hums one Ridesharing Works for Austin PAC commercial, “ridesharing drivers should have national criminal background checks.”

If Proposition 1 fails, Uber and Lyft have threatened to leave Austin. If the companies follow through (as they have done in San Antonio, Kansas City and countless other cities, although Uber remains in Houston after issuing threats to leave last month), the field will be open to other players.

Ride-hailing company Get Me has positioned itself at the forefront, saying it would comply with the city’s fingerprint-based background check requirement should Proposition 1 fail.

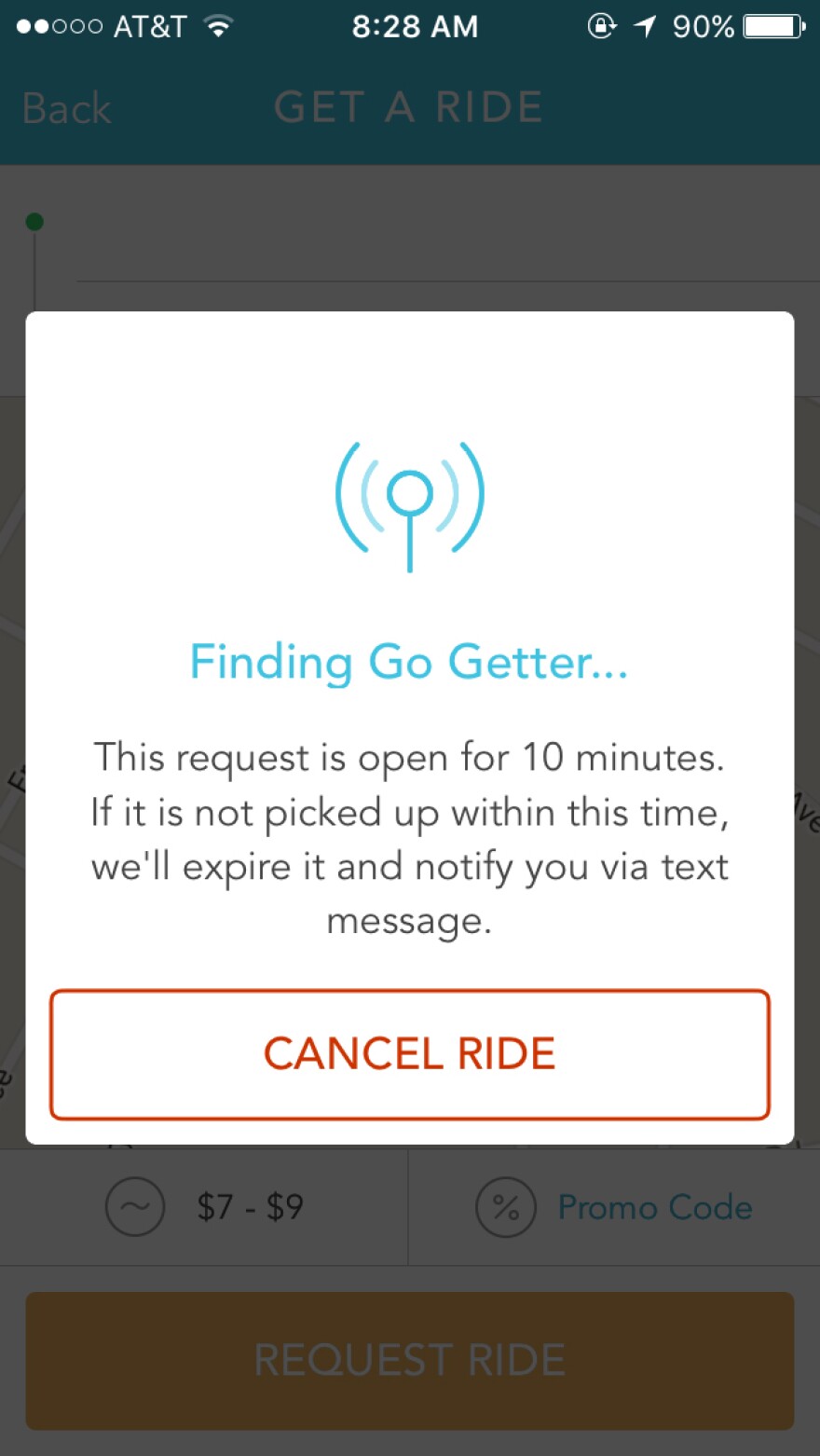

“The election is something we’re not really that concerned with,” said co-founder and Chief Experience Officer Jonathan Laramy. “It’s in the hands of the Austinites. We’re there to stay.” (This reporter attempted to take a Get Me to work Wednesday, but after the app searched for ten minutes before the ride was cancelled for lack of drivers).

But in reality, the field could be open to many players. In addition to Uber, Lyft and Get Me, the city’s list of current transportation network company (TNC) licenses includes Wingz and zTrip.

Harlan Beverly, a professor at University of Texas’ Venture Labs, said the technology behind ride-hailing apps is not, relatively, that complex.

“There’s no true technology advantage that Uber or Lyft has that somebody else can’t replicate quickly,” said Beverly. “For example, geo-location and best available driver technology. Those kinds of things, they’re not super complicated.”

Plus, Beverly says, should Uber and Lyft make an exit, thousands of once on-demand drivers will be out of a gig – and looking for work. He said capturing these folks before they go elsewhere has been Uber’s and Lyft’s advantage.

“They’re able to attract more drivers because of their brand power,” said Beverly. “But as soon as they’re gone and no longer an option for drivers who live here in the Austin area, those drivers are simply going to switch to the next more popular service.”

But the true test will be a company’s ability to scale-up to Uber’s or Lyft’s level. Get Me has roughly 500 drivers. While Uber and Lyft don’t give out exact numbers, both companies have said they have more than 10,000 drivers in Austin. Harlan said if a company has the capital, it could take one to two months to reach these heights. But Josh Jones-Dilworth, a local tech consultant who helped Mayor Steve Adler devise with his “Thumbs Up” program, said it would be much harder to fill the void.

“If you expect Get Me to come in and slurp up the excess capacity, that’s not going to happen,” he said, adding that competitors could still ramp up significantly. “I would expect that within four to six weeks they could radically change the amount of capacity they provide.”

But should Prop 1 fail, there’s still the question of how the city’s fingerprinting process would work. For example, the penalties that companies who fail to meet the city’s fingerprinting requirements set out in the ordinance passed in December still remain to be set in a separate ordinance.