Texas has almost $9 billion in “unclaimed property.” Those are funds from uncashed paychecks, unclaimed refunds and deposits, and money and safe deposit contents from dormant bank accounts.

If money hasn't been claimed or a check hasn’t been cashed after a few years, the holder of the asset (like the bank) must send the money to the Texas Comptroller. People can still get their money back, but they have to know to look for it by going to ClaimItTexas.gov.

Type in your name or the name of your business to see if you have money to be claimed — like a credit balance owed to you from your cable provider or a returned deposit from your old apartment complex. If you find money listed on the site that you believe is yours, click the “claim” button and submit any requested documents to prove the money is yours. After your claim has been verified, the state will send you a check.

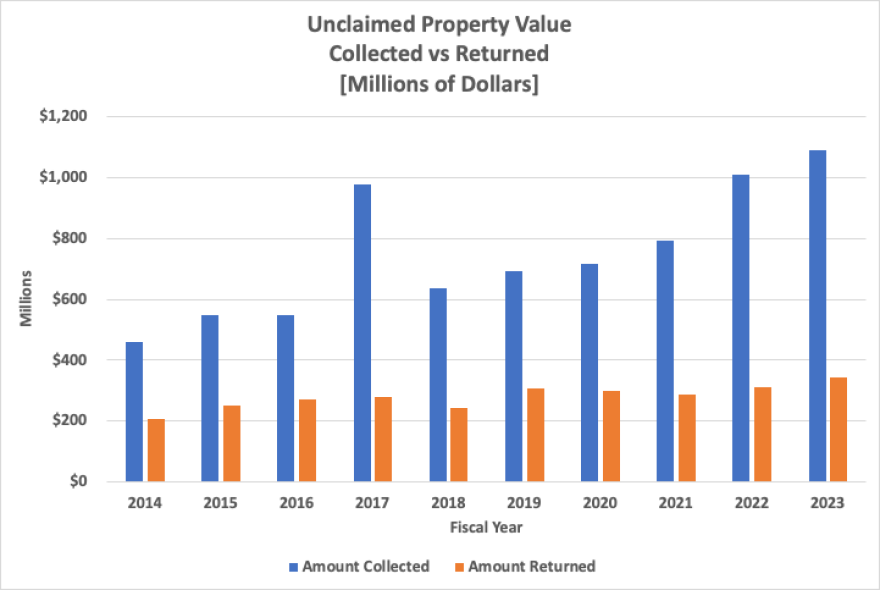

The rate at which the Texas Comptroller’s office is collecting money, however, is far outpacing the rate the office is returning it. According to Bryant Clayton, the assistant director of the Unclaimed Property Division, in fiscal year 2023, for example, the state collected $1.1 billion, but returned only about a third of that — or $340 million.

There are now more than 73 million unclaimed properties with a total value of $8.8 billion. That money sits in the state's General Revenue Fund to be used in the budget. It's also earning interest — for the state.

The Texas Comptroller’s office started a pilot program this year to proactively return money to people. Clayton said it identified 1,000 unclaimed properties worth less than $5,000 each for which it could reasonably determine the owner’s address. The office sent letters to people letting them know to expect a check in the mail. Some letters weren’t deliverable. In the end, he said, the office mailed out only 596 checks for a total of about $186,000.

By January, the office will evaluate the effectiveness of the pilot program by checking how many of those 596 checks were cashed — and if they were cashed by the right person.

“That’s always one of our items we’re thinking about is: Are we getting property back to the right person?” Clayton said.

Clayton said his team looked to what other states were doing to return property to residents, but Texas had a unique problem.

“Texas doesn’t have a personal income tax,” he said. “And so, citizens of the state of Texas don’t routinely interact with our office. And we don’t necessarily get, every year, someone’s current address because they’re filing personal income tax. And so, we don’t have that same level of direct data that other states do in trying to reach out to their citizens.”

Clayton said his office has tried various outreach campaigns to return money to people, groups and entities like cities and school districts.

“We will continue to do that,” he said. “Although, I will tell you, it can be tough to make the justification to spend time doing that when we already have folks filing claims with us to the point where our claims examiners are busy all the time.”

Then there’s the issue of individuals not believing you are trying to return money to them, he said.

“A lot of people won’t take the call," he said about his own experience calling people. "People won’t believe you are who you say you are.”

Clayton said the best thing his office can do is publicize its website for claims. The site only lists funds over $25, but you can contact the office for a complete search of any unclaimed properties in your name.

Most of the claims filed with the office are by people trying to get their own money back, but about 13% of claims filed since 2018 are by heirs trying to claim the funds of, say, a deceased parent. The process gets more complicated because claims officers have to verify the person has died, find their latest will and identify all the heirs.

“We have to make sure we are returning property to the rightful owner,” Clayton said.